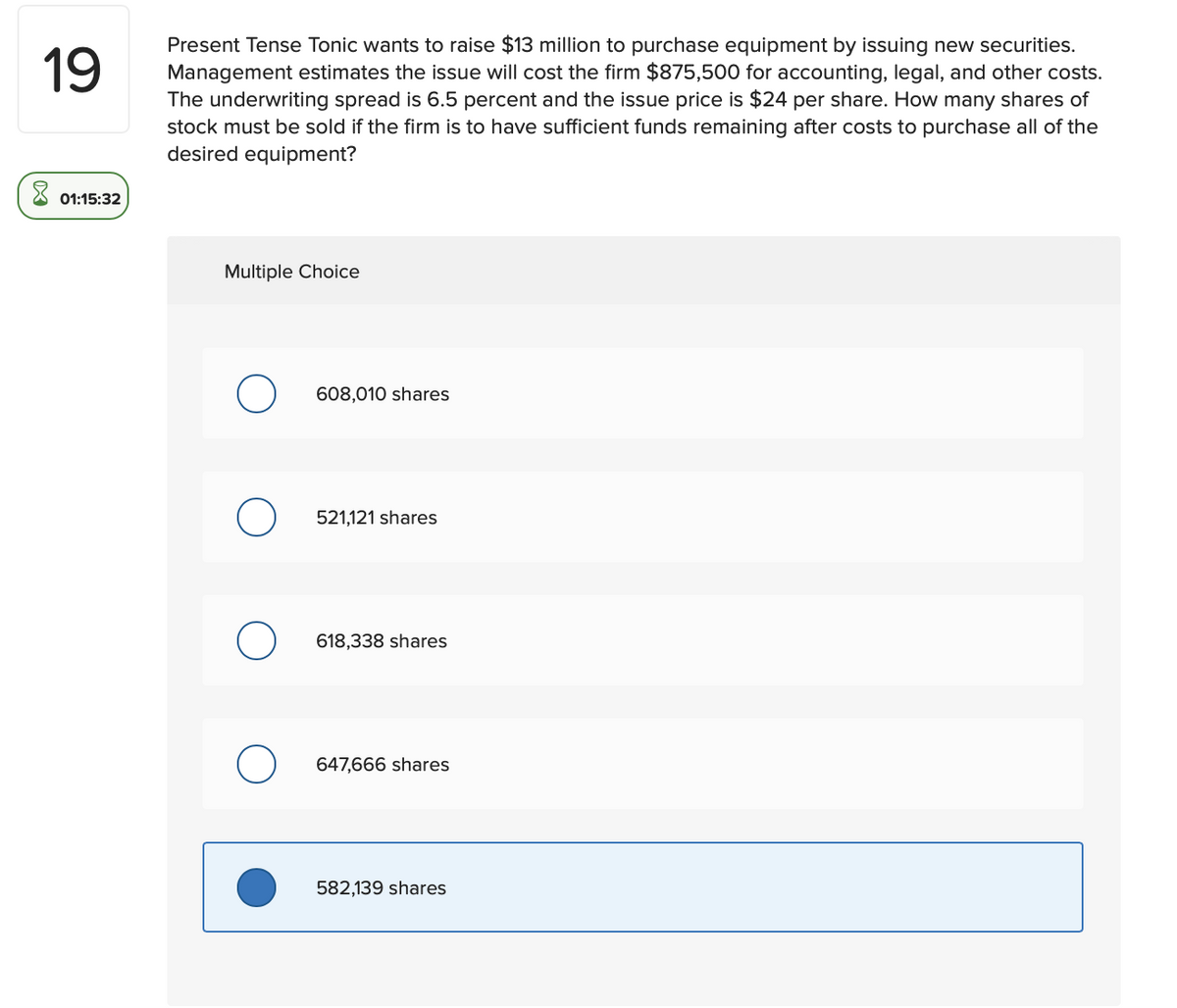

This expansion of the investor base could lead to heightened risk in the market if it leads to volatile flows of money into and out of the market.Ĭhart 1: The Market For Corporate Private Debt Has Grown 4x Over The Past Decade More recently, private debt funds have been marketed as an alternative asset and are increasingly accessible to individual investors through new classes and funds. This came as institutional investors with a fixed-income allocation (e.g., insurers, pensions, endowments, and sovereign wealth funds) have increasingly waded directly or indirectly into the market. Listen to a synopsis of this research, read by one of our lead authors.Īssets under management of funds primarily involved in direct lending surged to $412 billion at end-2020-including nearly $150 billion in “dry powder” available to buy additional private debt assets-according to financial-data provider Preqin (see chart 1). The growing investor base, a lack of available data, and the distribution of debt across lending platforms make it hard to know how much risk is in this market-and who holds it. The market has grown tenfold in the past decade. After reading this article you will learn about the Underwriting of Capital Issues:- 1.Private debt has emerged as a new frontier for credit investors in their search for yield, and for borrowers and lenders seeking closer bilateral relationships. Underwriting in the context of a company means undertaking a responsibility or giving a guarantee that the securities (shares and debentures) offered to the public will be subscribed for. The firms which undertake the guarantee are called ‘underwriters’. Underwriting is similar to insurance in the sense that it provides protection to the issuing company against the failure of an issue of capital to the public. It ensures success of new issues of capital and if the shares or debentures are not subscribed by the public. Wholly, the underwriters will have to take them up and pay for them. Underwriting is, therefore, an act of undertaking the guarantee by an underwriter of buying the shares or debentures placed before the public in the event of non- subscription.Īccording to SEBI Rules 1993, underwriting means an agreement with or without conditions to subscribe to the securities of a body corporate when the existing shareholders of such body corporate or the public do not subscribe to the securities offered to them.

‘Underwriter’ means a person who engages in the business of underwriting of an issue of securities of a body corporate.

The underwriters, for providing this service to the issuing companies charge a commission generally calculated at an agreed specified rate on the issue price of whole of the shares or debentures under written. Such a commission is called underwriting commission which is payable on the whole of shares or debentures underwritten even if the public takes up all the shares or debentures offered. The issuing company has, thus, to enter into an agreement with one or more underwriter/s who may be either an individual, a firm, bank or some financial institution. In an English case, the learned Judge defined underwriting as “an agreement entered into before the shares are brought before the public that in the event of the public not taking up the whole of them or the number mentioned in the agreement, the underwriter will, for an agreed commission take an allotment of such part of the shares as the public has not applied for”. In all the six forms of underwriting agreements discussed above, the underwriters provide the services on commission basis.

However, in some cases the underwriters, instead of undertaking guarantee to buy shares or debentures not subscribed by the public, may enter into an agreement to out-rightly purchase the issue (shares or debentures) at an agreed price and arrange to sell the same latter through their own arrangements. Whenever new issues of capital are made, there is always certain risk of non-subscription or under- subscription of securities by the public.

The plans of the promoters of the companies remain unimplemented and their reputation adversely affected if the issues are not successful. Underwriting is a safer way of marketing securities for new issues of capital. It is an insurance in the sense that it provides protection against such risks. Thus, it is a very useful method of raising finance through issue of securities (shares and debentures). It is not only the issues of equity share capital that need be underwritten.

0 kommentar(er)

0 kommentar(er)